oregon tax payment due date

Electronic payment from your checking or savings account through the Oregon Tax Payment System. Key Dates for 2021.

Delaware Commercial Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Edi Lease Agreement Legal Forms Being A Landlord

Due Dates for 2021 - 2022 Tax Payments.

. For more information please visit our. The Oregon tax payment deadline for payments due with the 2019 return by May 15 2020 is automatically extended to July 15 2020. Individual taxpayers can now postpone federal income tax payments for the 2020 tax year normally due on April 15 2021 to.

Both the filing and payment deadlines have been extended for personal income and corporate incomeexcise taxes. Federal Tax Form 1040 KATU PORTLAND Ore. Annual Use Fuel User - Vehicle Weight.

The Oregon return filing due date for tax year 2019 is automatically extended from May. Last date to file individual refund claims for tax year 2018. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs.

April 15 Last day to file CAT return without an extension or apply for an extension for filing a CAT return. Pay the in full amount by November 15 to get the 3 percent discount. Please remember Oregon city income tax returns are due April 15th or if it falls on a weekend the first business day after April 15th.

Where is My Refund. Estimated tax payments are still due April 15 2021. 4th 10-1 to 12-31 January 20.

The governors state-declared emergency due to the COVID-19 pandemic and the action of the IRS will impair the ability of Oregon taxpayers. Here is a list of frequently asked questions which will be updated as more information. Payments that are received after following years first quarter estimated tax due date April 15 2020 will be applied to estimated tax as of the date the payment is received.

Quarter Period Covered Due Date. Oregon doesnt tax your military pay if you arent an Oregon resident. The Oregon Department of Revenue released more details later the same day.

Due to the recent changes made by the IRS and the Oregon Department of Revenue pursuant to Revenue Division Policy the Revenue Division has made the following updates to the filing and payment due dates for tax year 2020Portland Arts Education and Access Income Tax Arts Tax Tax Year 2020 Filing and Payment Deadline. Accordingly the first CAT payment is due April 30 2020. Oregon has not postponed the due date for first-quarter estimated income tax payments for 2021.

Reports must be received by the department on or before January 20 for each year. November 15th Monday 2021 February 15th Tuesday 2022 May 16th Monday 2022. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department.

By July 31 2020 those with substantial nexus with Oregon and an annual CAT liability exceeding 10000 must pay 25 of their CAT liability for the 2020 calendar year. If you performed active military service in 2021 and your Defense Finance and. April 15 July 31 October 31 January 31.

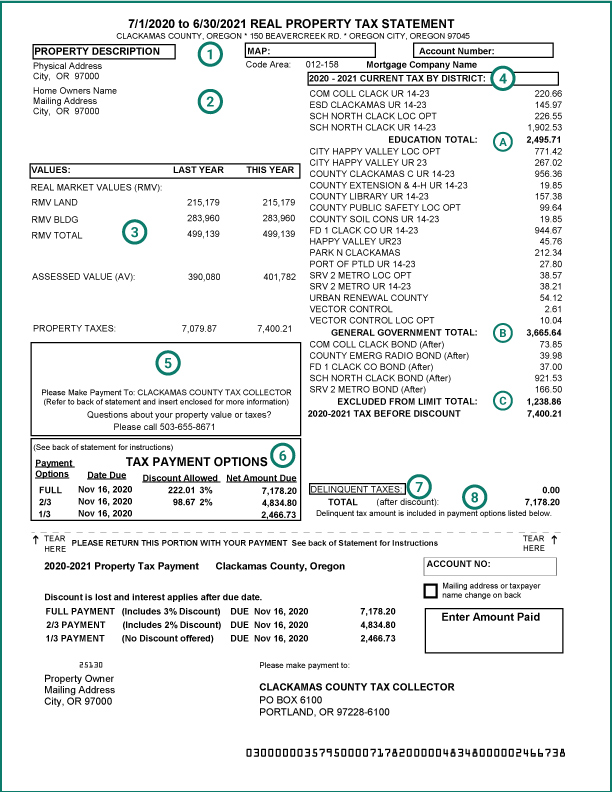

2nd 4-1 to 6-30 July 20. The Oregon Department of Revenue said Wednesday it is joining the IRS and automatically extending the income tax filing due date for individuals for the 2020 tax year from April 15 to May 17. The statements are mailed between October 15 and October 25 to each property owner in the county.

Any tax payment with a. If you do not receive your statement by November 1 call the Tax Department at 503 588-5215. Oregon property taxes are assessed for the July 1st to June 30th fiscal year.

Marion County mails approximately 124000 property tax statements each year. The Oregon return filing due date for tax year 2019 is automatically extended from May 15 2020 until July 15 2020. More information about the postponement of the individual income tax filing and payment due.

Important Dates Installment Options Postmarks. The Oregon tax payment deadline for payments due with the 2019 return by May. Service provider fees may apply.

August 2 Second quarter 2021 CAT estimated payments due. If you choose this installment schedule the final one-third payment is due on or before. The 2019 Oregon corporation incomeexcise tax overpayment will be applied of the date the payment was received by the department.

After much debate and pressure from a number of accounting professional groups the Internal Revenue Service recently announced that it is pushing back the individual tax filing and payment deadline from April 15 2021 to May 17 2021. Mail a check or money order. Corporate Income and Excise.

Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT. April 30 First quarter 2021 CAT estimated payments due. 1st 1-1 to 3-31 April 20.

The Oregon return filing due date for tax year 2019 is automatically extended from April 15 2020 to July 15 2020. Taxpayers may choose to pay directly from their bank account or by credit card using Revenue Online. To federal estimated tax payments due on April 15 2021.

Generally taxpayers that fail to timely make estimated tax payments or underestimate their estimated tax payments by more than 20 percent percent will be subject to a penalty. The due dates for estimated payments are. Tax statements are sent to owners by October 25th each year.

The Oregon tax return filing due date for tax year 2019 is automatically extended from May 15 2020 until July 15 2020. Pay the two thirds amount by November 15 to get a 2 percent discount. 3 While Oregon has extended some of its tax filing and payment deadlines in response to the COVID-19 outbreak it has not extended the due dates for estimated quarterly payments.

Returns due after May 15 2020 are not extended at this time. Returns filed late will incur a 2500 late filing fee as well as monthly penalty 1 ½ and interest 12 charges. The Department of Revenue DOR has issued a Directors Order providing relief similar to that provided by the IRS by postponing the Oregon filing and payment due date for individuals for tax year 2020.

Electronic payment using Revenue Online. Subscribe to Tax Calendar. February 1 Fourth quarter 2020 CAT estimated payments due.

Returns due after May 15 2020 are not extended. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended. Property taxes may be paid in installment payments using the following schedules.

Central Oregon Tax Connection. 3rd 7-1 to 9-30 October 20. After the Internal Revenue Service extended the deadline for people to file their taxes this year from April 15 to May 17 the Oregon Department of.

The first payment is due by November 15th. Choose to pay directly from your bank account or by credit card. Payments for returns due after May 15.

Please see Form OR-65 Instructions for due dates for non-calendar-year filers.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2021 Tax Returns Deadlines And New Developments For Employers

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Usa Ohio Lorain Medina Rural Electric Utility Bill Templa In 2022 Bill Template Lorain Templates

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Audit Internal Revenue Service

Blog Oregon Restaurant Lodging Association

Explore Our Free 30 Day Notice To Vacate Oregon Template 30 Day Eviction Notice 30 Day Eviction Notice

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

Federal Income Tax Deadline In 2022 Smartasset

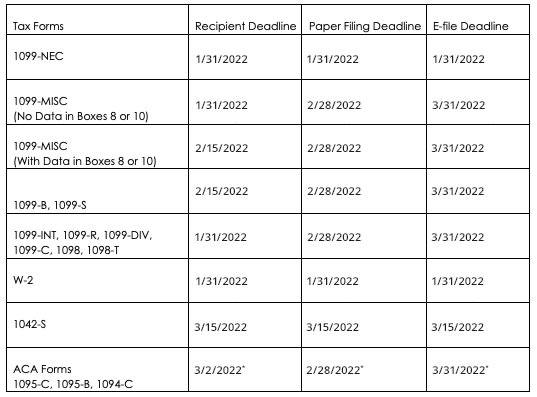

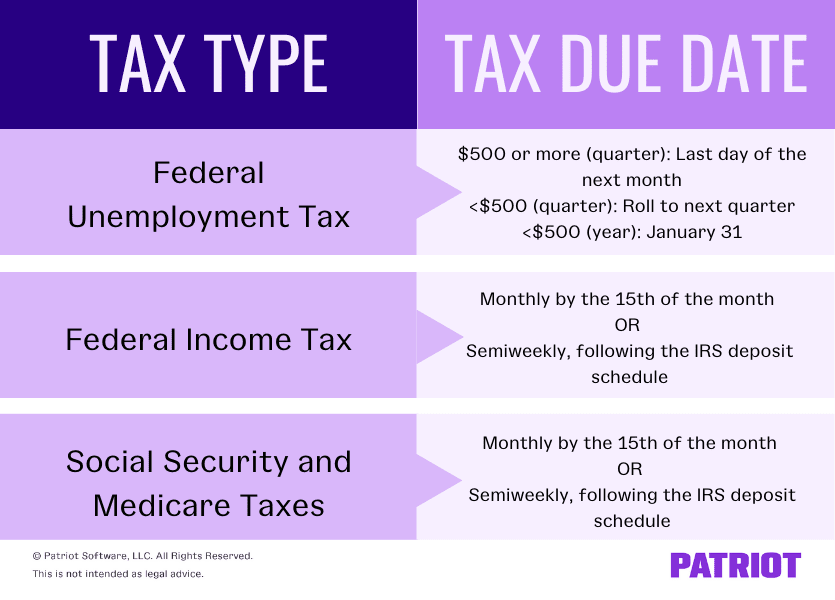

When Are Federal Payroll Taxes Due Deadlines Form Types More

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Understanding Your Property Tax Bill Clackamas County

Federal Tax Due Date Changes For 2016 Filing

2020 Tax Deadline Extended Taxact Blog

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic